Banks can also send personalised recommendations and nudges on steps they can take to reduce and offset their impact, helping to increase engagement. Providing customers with information on the impact of their spend on their carbon footprint motivates them to log-in and engage. Banks also reap the following benefits: Improve brand reputationĬustomer facing sustainability efforts can enhance the reputation of a company, increase brand value and position the bank as a leader in sustainable finance solutions. Benefits of carbon tracking for banksīy providing customer transparency, banks play a vital role in the fight against climate change: inspiring widespread climate action. Now that’s powerful, scalable climate action. If this behaviour was replicated across NatWest’s 8 million customers who use the mobile app, it would save more than 1 billion kg of CO2 emissions per year, equivalent to planting 17 million trees. Insights from a pilot we carried out with Natwest showed the average user saved approximately 11 kg of CO2 emissions per month by committing to behavioural changes that used less carbon – such as composting, reducing meat consumption, or switching utilities providers.

The power of carbon trackingįinancial institutions can scale their impact by involving their customers in climate action instead of solely relying on in-house CSR initiatives. And banks can seamlessly integrate carbon trackers (like Cogo 😉) into their digital experience to quickly analyse, categorise and translate transaction data into simple carbon insights for customers. Luckily, AI can help make this process a lot simpler. Through customer feedback loops, the calculations are then refined. The categories are then contextualised with research and publicly available emissions data to give consumers their calculations. How does this work? Most approaches break spending down into categories, for example, food, gas, transport, etc. With many different sources of GHG emissions, calculating a carbon footprint can be a complex process.Īs carbon emissions are linked with spending, one efficient way to estimate a customer’s footprint is to use transaction data. Many of our daily activities-like driving and heating our homes-produce greenhouse gas emissions. What is carbon tracking? And how does it work?Ĭarbon tracking is essentially a way to measure an individual's carbon footprint.īreaking this down further, a carbon footprint is defined by the World Health Organisation (WHO) as a “measure of the impact your activities have on the amount of carbon dioxide produced through the burning of fossil fuels.” Not only does this solution help meet customers’ needs but it empowers banks to engage with customers and make a meaningful contribution to solving climate change.

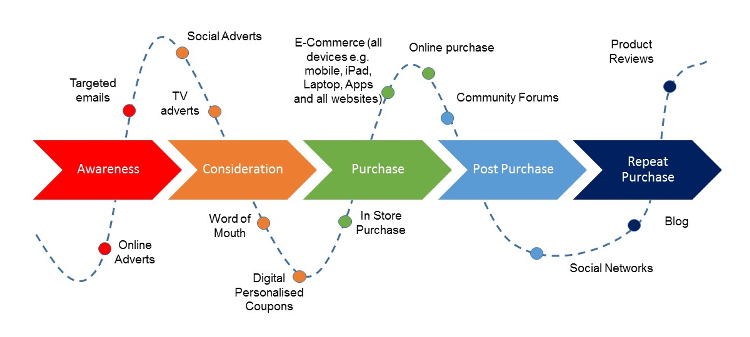

Tracking can also influence users to make more sustainable behaviour change and it offers ways to offset carbon. Banks can integrate carbon tracking into their offering to enable their customers to understand the impact of their spending.

0 kommentar(er)

0 kommentar(er)